How to Pay BIR Taxes and Fees via PayMaya and GCash, A Step by Step Guide

I really have to hand it to the teams behind the Philippines' leading

online payment platforms, PayMaya and GCash, for always

coming up with ways to make life easier and more convenient for millions

of Filipinos, especially amidst the challenges of the COVID-19

pandemic.

Personally, apart from allowing me to pay for my online purchases and send

money to loved ones more efficiently, my favorite use for PayMaya and GCash

is for settling utility bills and paying my BIR fees!

Yes, if you don't know it yet, you can actually pay your taxes other fees

to BIR through both PayMaya and GCash. No need to go to a physical bank or

even to your RDO branch! You can accomplish the entire process via mobile

apps.

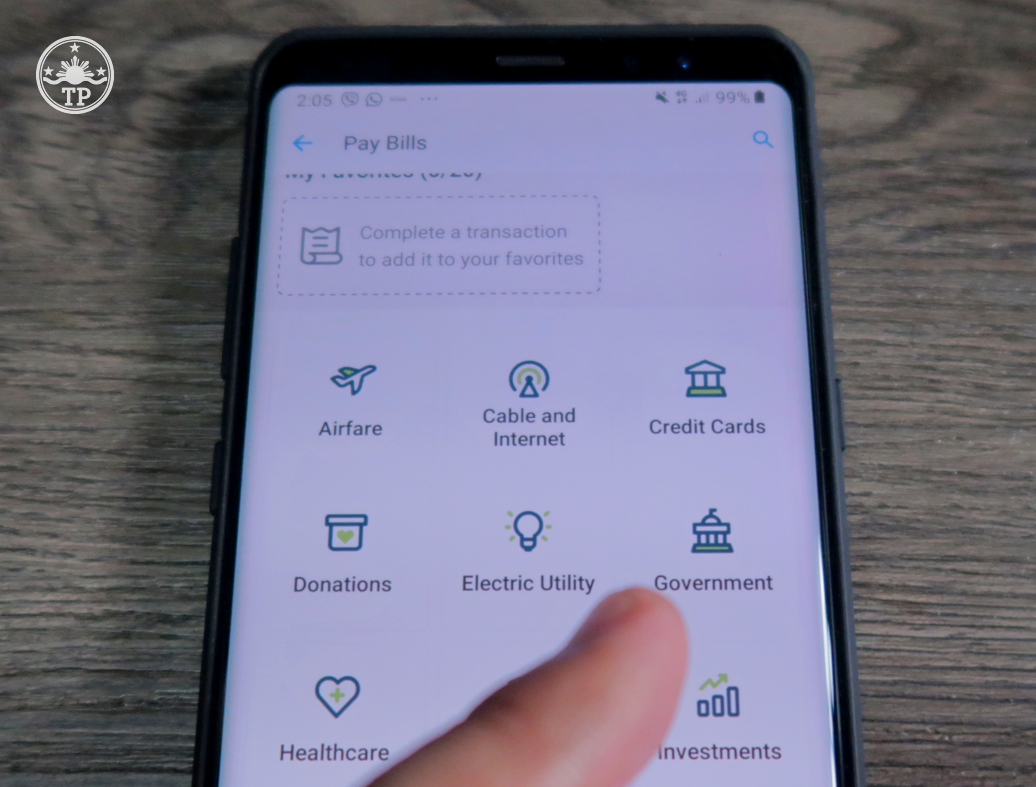

Here's how you do it with PayMaya:

1. Launch the app and log in to your account.

2. Tap on the "Pay Bills" icon on the home screen as shown in the image

above.

3. Go to "Government".

4. Then, click on "Bureau of Internal Revenue" (BIR) as shown below.

5. Read PayMay's BIR Payment Reminders. Basically, these tell you that your

TIN number has 9 digits and your Branch Code must have 5 digits.

It's very important for you to know your correct TIN number and Branch Code.

If you don't have these numbers yet, I suggest you get them from your

Accountant or your company's Accounting Department.

To close the Reminder, simply tap on X in the upper right corner of the

pop-up message.

6. Simply fill in the blanks, making sure that you type all the details

correctly.

In this tutorial, I tried paying for Form 0605 Registration Fee.

7. You can double-check the RDO Code, BIR Form Series, Form Code, Tax

Type, and Return Period on similar BIR Forms you have used to file taxes

or pay fees in the past.

Make sure you type in your email address in the space provided. PayMaya

will send a confirmation email to you once the payment has been

processed.

8. Once you've made sure that all details are correct, tap "Continue" near

the bottom of the screen.

9. PayMaya will show you an outline or summary of the BIR payment you're

about to make. Again, if all details are accurate. If you see something

wrong, go back and correct it. Once everything looks good, tap "Pay".

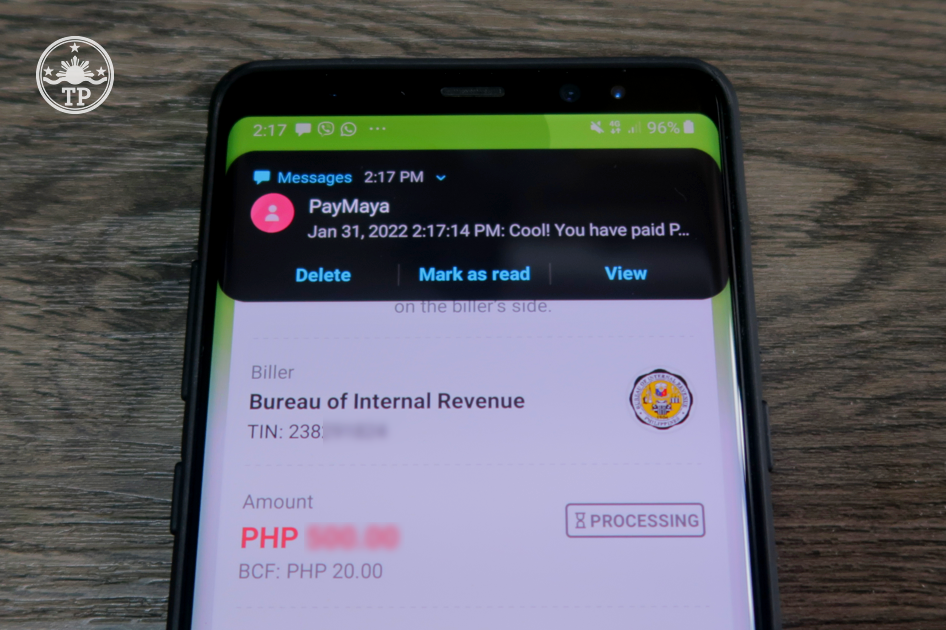

10. PayMaya will process then process the payment and give you a reference

code for the transaction.

For this transaction, PayMaya charged a PHP 20 Biller Convenience Fee (BCF).

You will also receive a text message from PayMaya confirming the BIR

payment.

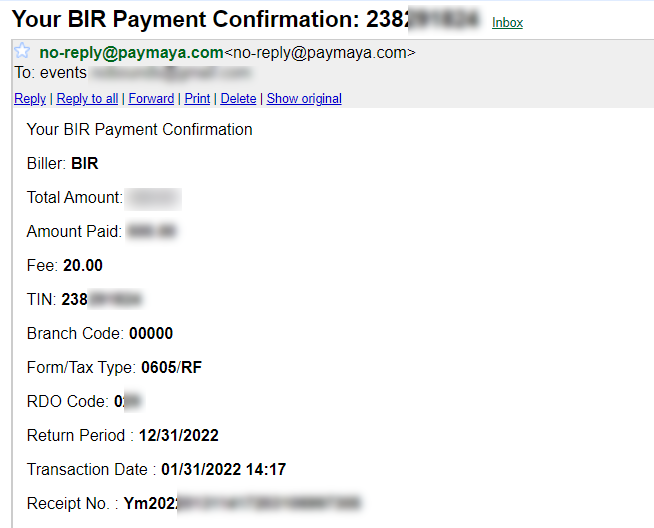

PayMaya will also send you an email to the account that you provided,

confirming that the BIR Payment has been processed.

So easy, right?!

Now, here's how you do it with GCash.

1. Launch the app and log in to your account.

2. Tap "Pay Bills" icon on the home screen.

3. Go to "Government" as shown in the image above.

4. Tap "BIR".

5. Fill in the details, making sure that you type everything accurately.

Again, your TIN number should have 9 digits and your Branch Code must have 5

digits; Get these from your Accountant or your company's Accounting Office.

6. Make sure that you choose the correct BIR Form Number and Tax Type for

the BIR payment you'll be settling.

7. Type in your correct BIR Branch Code as well as the right Return Code for

the specific transaction.

8. After double-checking the details, tap "Next".

9. GCash will then show you a summary of the BIR payment you're about to make.

Again, check if all details are correct. Go back if you see something wrong.

If everything looks good, tap "Confirm" then "Pay" on the next screen.

10. Wait for the confirmation text message and email from GCash once the

payment has been processed successfully.

There you have it, TP Friends! That's how you pay your BIR taxes and fees

via PayPal and GCash. I'd say that the most challenging parts have to do

with making sure that you know your BIR details plus BIR Form numbers and

that you type or choose them correctly on both mobile apps. Cheers!