Global Smartphone Market Enters Maturity As Consumers Desire More Premium Models

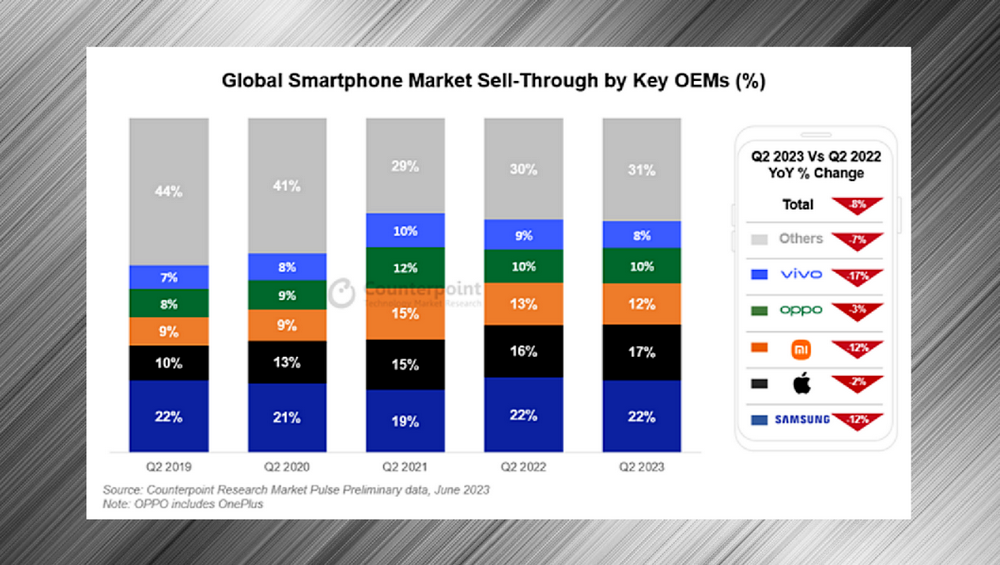

According to Counterpoint's Market Pulse service, the global

smartphone market experienced an 8% year-on-year decline and a 5%

quarter-on-quarter decline in the second quarter of 2023. This marks the

eighth consecutive quarter of year-on-year decline.

In terms of market share, Samsung led the market with 22%, benefiting from the

strong performance of its Galaxy A-series worldwide. Apple came in second

place, achieving its highest-ever market share for the second quarter. Xiaomi,

the third-largest brand, faced challenges in its major markets, China and

India, but is seeking to offset these declines by expanding into other markets

and refreshing its product lineup. OPPO performed relatively well in its home

market of China and India, thanks to OnePlus, managing to maintain its global

market share despite losses in Western Europe. vivo (including iQOO)

experienced significant growth declines in China compared to a strong second

quarter last year, and faced strong competition from Samsung and OPPO in the

offline markets of India and Southeast Asia.

Global Smartphone Market Has Matured

The global smartphone market appears to have moved past its period of rapid

growth, as consumer replacement cycles lengthen, device innovation converges,

and a more mature refurbished smartphone market emerges, particularly in the

lower- to mid-tier price segment.

However, the premium segment (smartphones priced at $600 or above wholesale)

continues to grow, as mature consumers opt for a superior experience and

finance options become readily available. The premium segment was the only

segment that experienced growth during the quarter, reaching its highest-ever

contribution to the overall market. More than one in five smartphones sold

during the quarter belonged to the premium segment.

Premiumization Era of Smartphones

Apple is capitalizing on this trend of "premiumization" and achieving record

shares in new markets that are typically not considered its core markets. For

example, it experienced a 50% year-on-year growth in Q2 2023 in India. The

strong performance of the premium segment has helped mitigate revenue declines

compared to sales volumes, prompting brands to invest in market expansion and

innovation in newer technologies.

Sales contracted in all regions worldwide, but the steepest decline occurred

in relatively more developed markets such as the US, Western Europe, and

Japan, all of which recorded double-digit annual declines. Markets in China,

India, and the Middle East & Africa experienced relatively smaller

declines. OEMs and channels attempted to clear excess inventory through

promotions and "big sale" festivals. However, demand remained weak due to

higher interest rates impacting disposable income in the US. In China, despite

aggressive promotions during the "618" premier sales event, the response was

lukewarm. Nevertheless, the event helped stabilize the decline in the Chinese

smartphone market and indirectly impacted the global market in June.

Despite these challenges, there is some positive outlook for the smartphone

industry. According to Counterpoint's Smartphone Inventory Tracker, global

smartphone inventory levels have reached healthy levels over the past four to

five months. This provides OEMs with breathing room to launch and promote

newer models in the second half of the year, encouraging consumers to upgrade

and accelerating the replacement cycle.

Overall, a slow recovery of the market is expected in the coming quarters.